“Tax laws have the purpose, not only of raising revenues, but also of offering incentives for the channeling of personal expenditures toward what are deemed to be socially desirable ends. The encouragement of public philanthropy, the stimulation of capital investment, home ownership rather than home renting – all these are taken to be things which are good for society as a whole, and which the tax laws should therefore help rather than hinder or even be indifferent to. Some economists look on these provisions as ‘distortions’ of what would otherwise be an elegantly simple mechanism for raising revenues, and as undesirable intrusions of social values into individual decision making. Most citizens, however, take it for granted that one of the responsibilities of government is precisely to affirm and sustain social values, and find it impossible to imagine a government that adopts a posture of absolute neutrality as to how people choose to spend their money.”

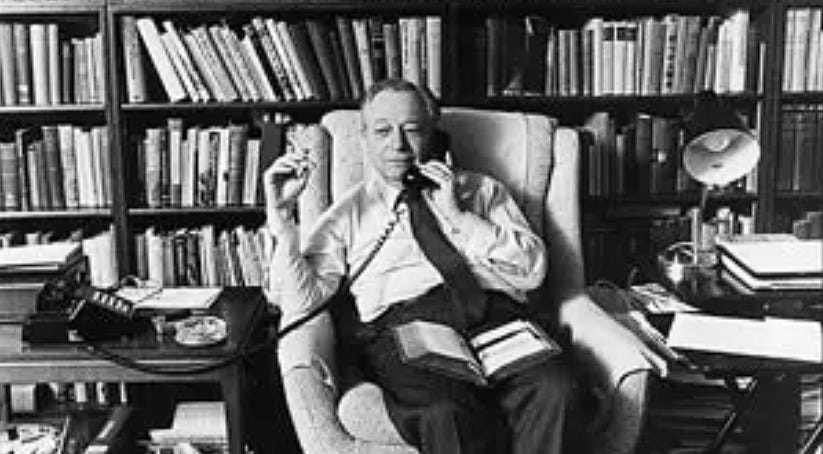

-Irvin Kristol, Two Cheers for Capitalism, p. 192

Two Cheers for Capitalism contains valuable lessons about why certain things in our economic order are the way they are. Many citizens struggle to see a reason for why tax laws contain “loopholes.” Not seeing a reason, they chalk it up to malfeasance.

Giving people a reason why things are the way they are goes a long way towards curbing their indignation. In the above quotation, Kristol lists some of the reasons for the “loopholes” in our tax laws which come in for so much ire. Those deductions are put in the tax code in order to incentivize individuals and corporations to adopt certain behaviors. Then, when wealthy individuals and corporations adopt those behaviors, and are rewarded with lower taxes, they are tarred and feathered in the court of public opinion for doing what they were encouraged by the government to do.

Kristol mentions “economists” who think taxes should serve the purpose of raising revenue, and that the government should be neutral about how people spend their money. I’m not an economist, but I would argue that the purpose of a tax is to pay for federal spending, and that a complicated tax code creates needless fragility and frustration. However, we live in the world we have, not the one we want. Many of the “loopholes” in the tax code were put there for a good reason.

-Ben

The Daily Saucer is our place for freelance contributors and editorial staff to offer short takes on the news cycle, quick observations on the issues, and brief thoughts on broader topics. The views offered in this space reflect only the personal views of the authors.